Ankara Microfinance App

Empowering microfinance institutions with efficient loan management and financial tracking

Institutions Served

Efficiency Gain

Empowering microfinance institutions with efficient loan management and financial tracking

Institutions Served

Efficiency Gain

Ankara revolutionizes how microfinance institutions manage loans, track repayments, and monitor financial performance.

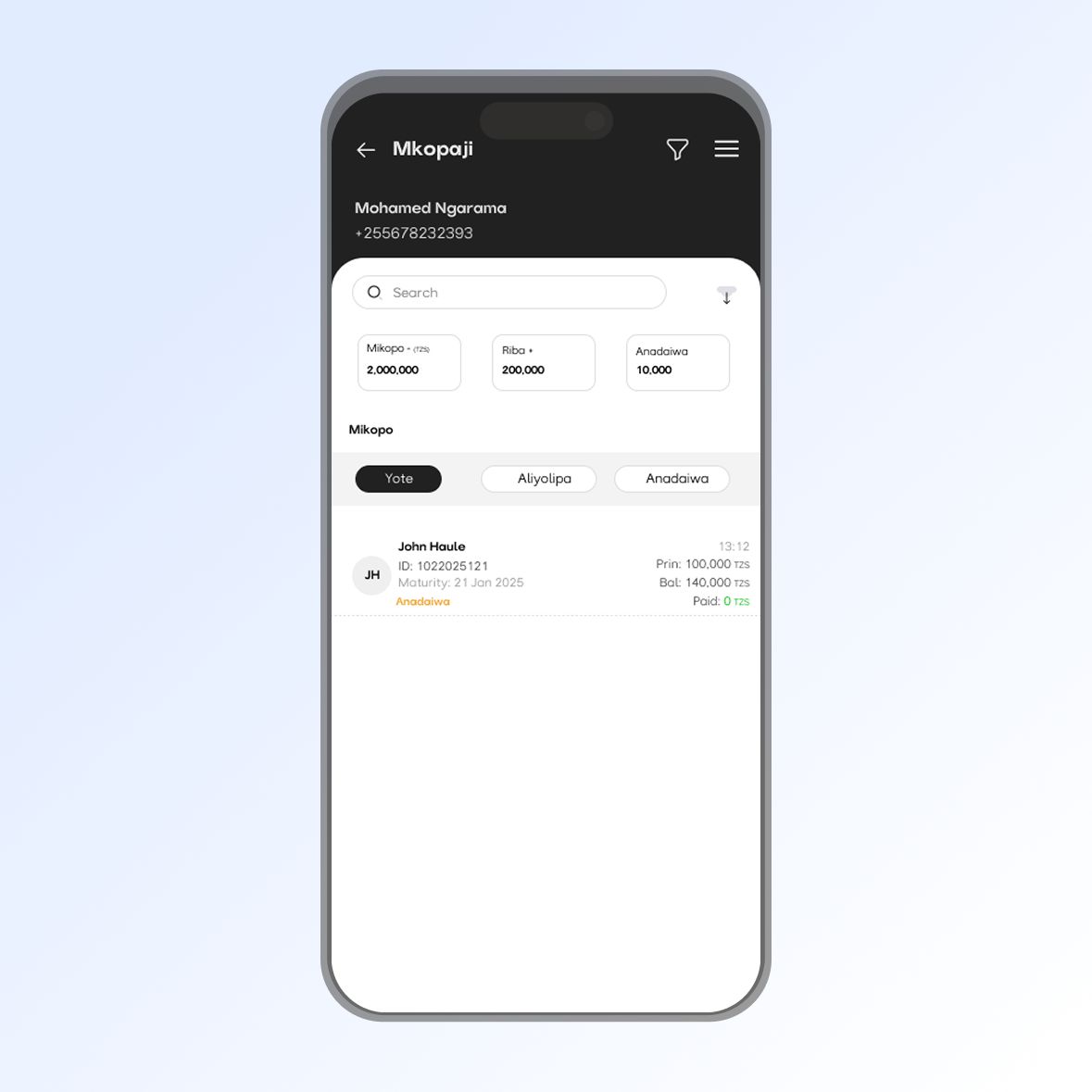

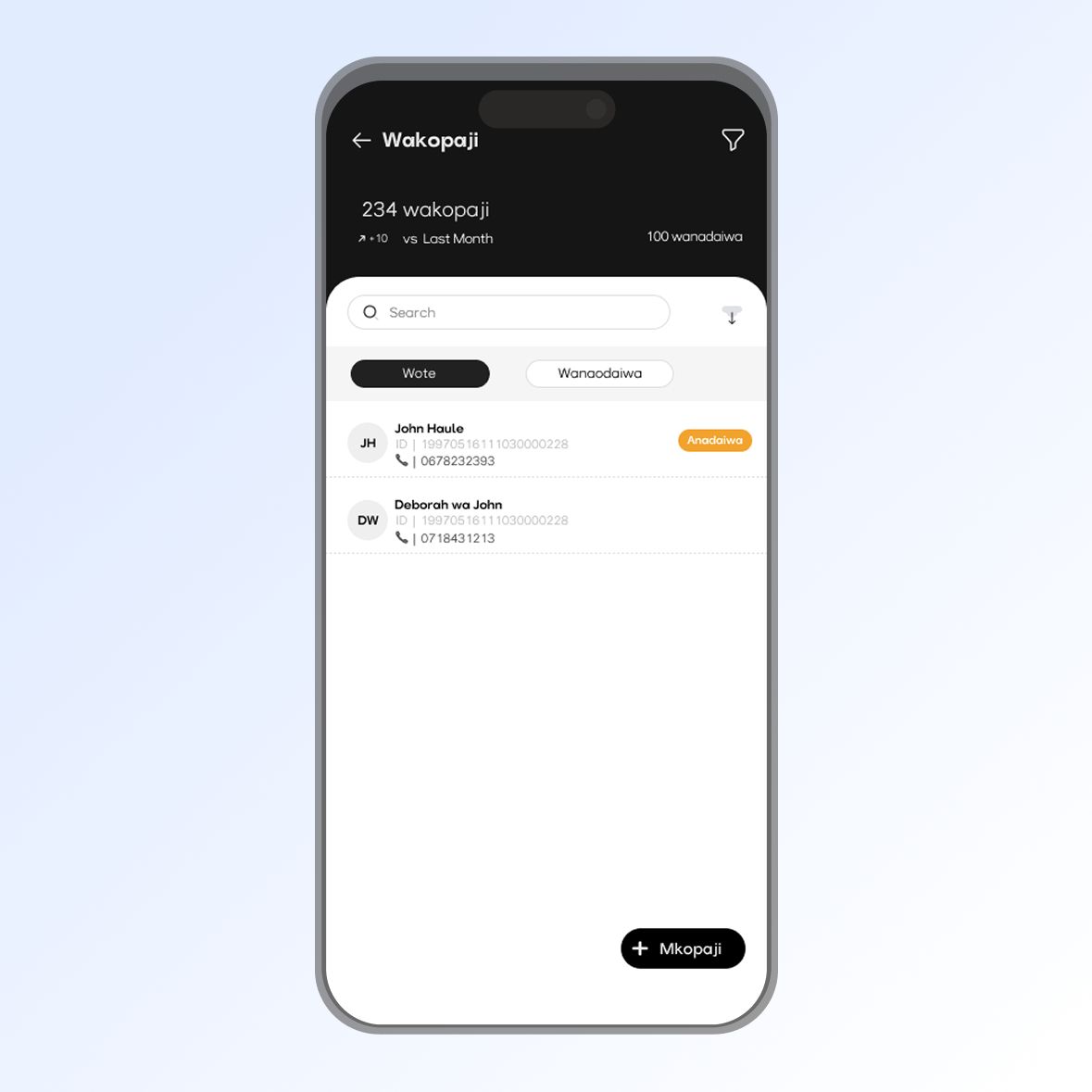

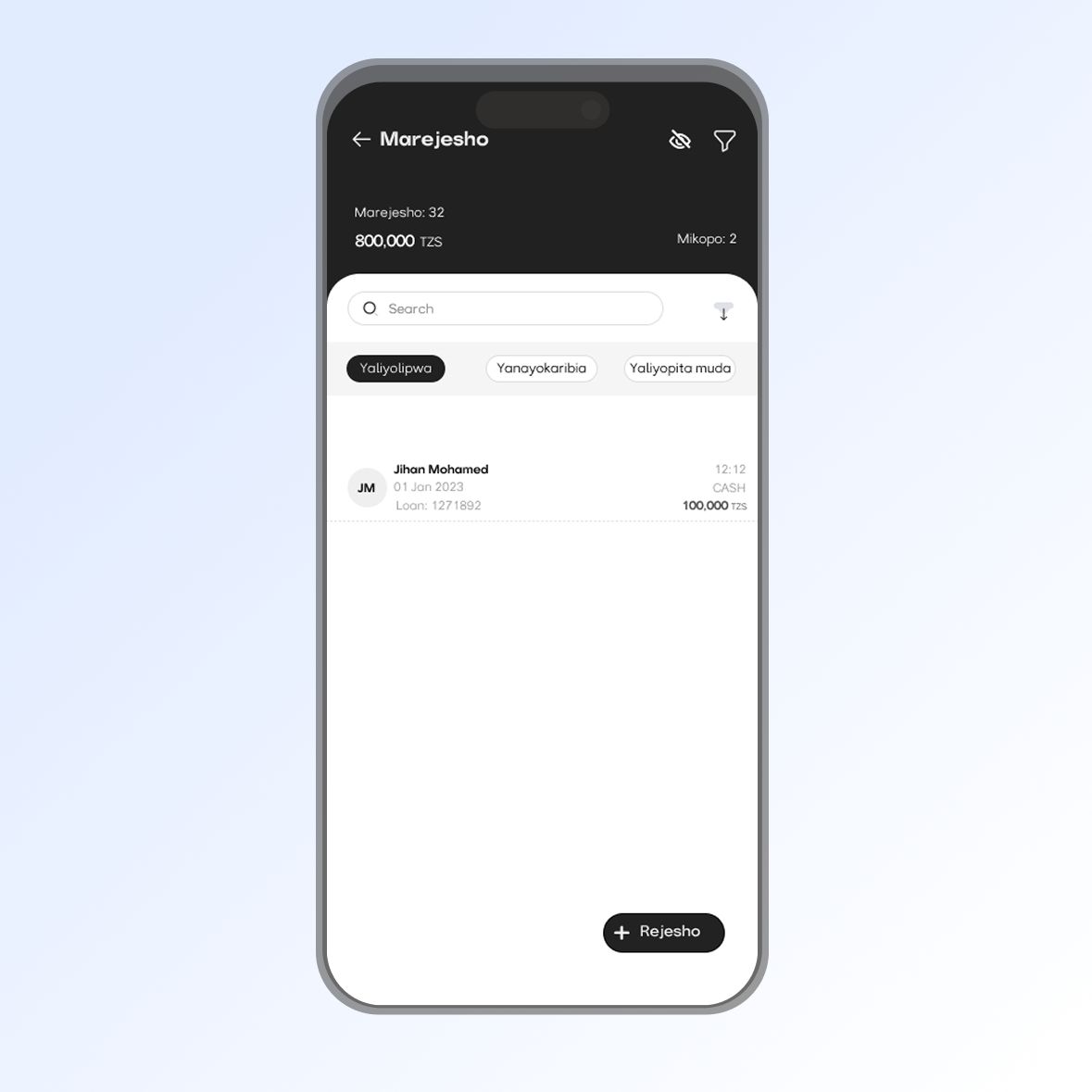

Monitor all active loans in one place

Track client repayments and balances

Automated interest and fee computation

Detailed financial insights

Traditional manual processes lead to errors and inefficiencies in microfinance operations.

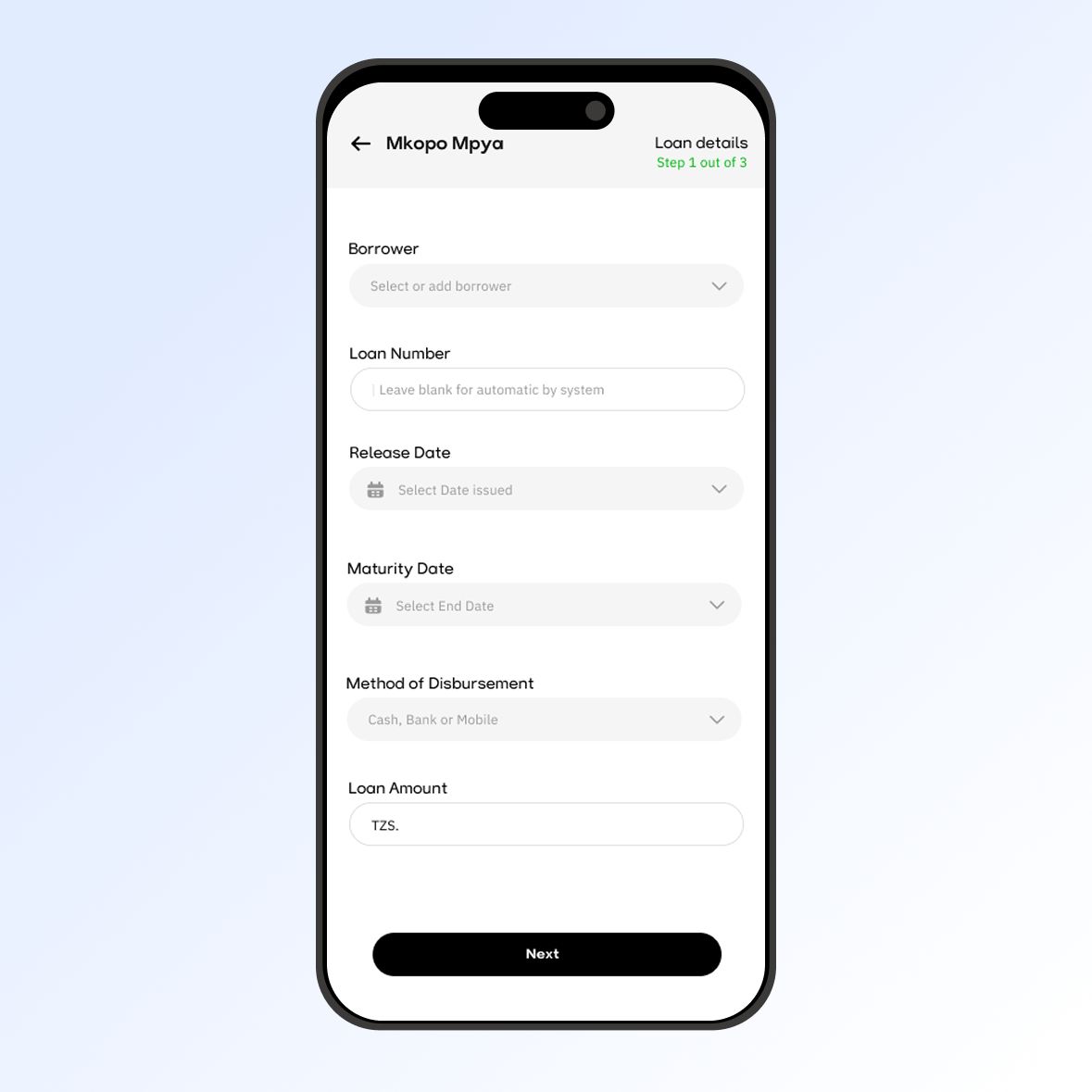

Reduce loan processing time by 50%

Ankara digitizes the entire loan lifecycle from application to repayment, ensuring accuracy and saving valuable time for microfinance agents.

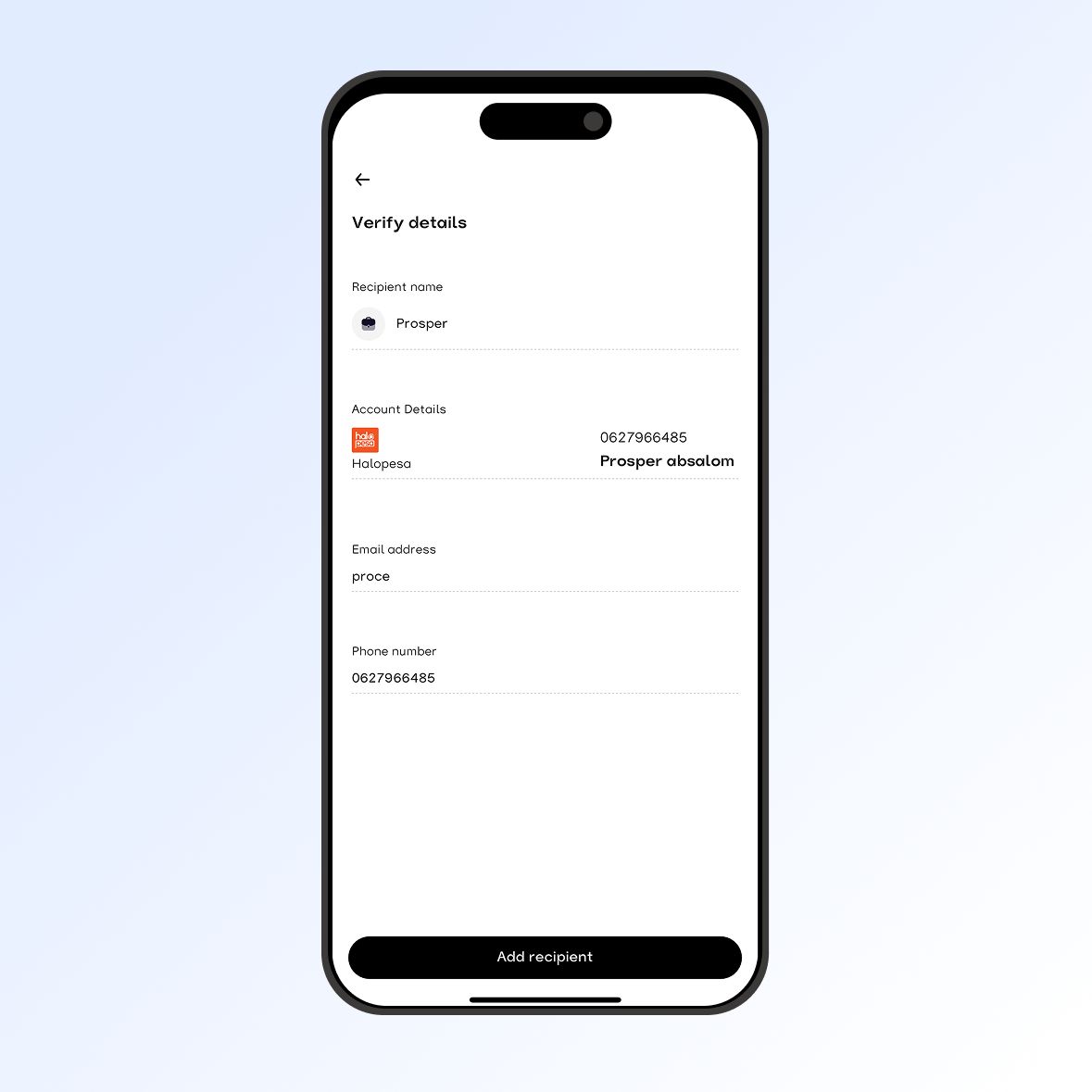

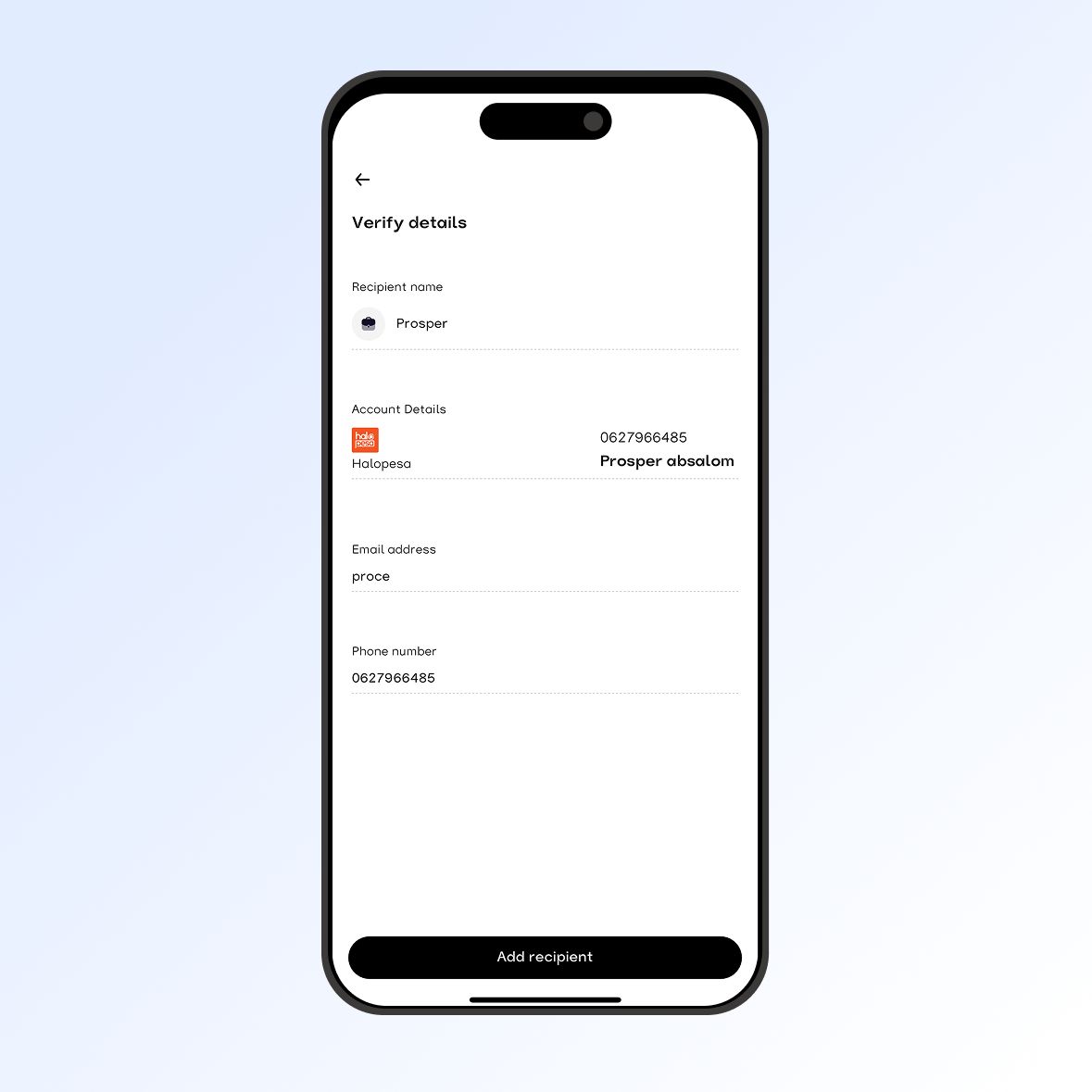

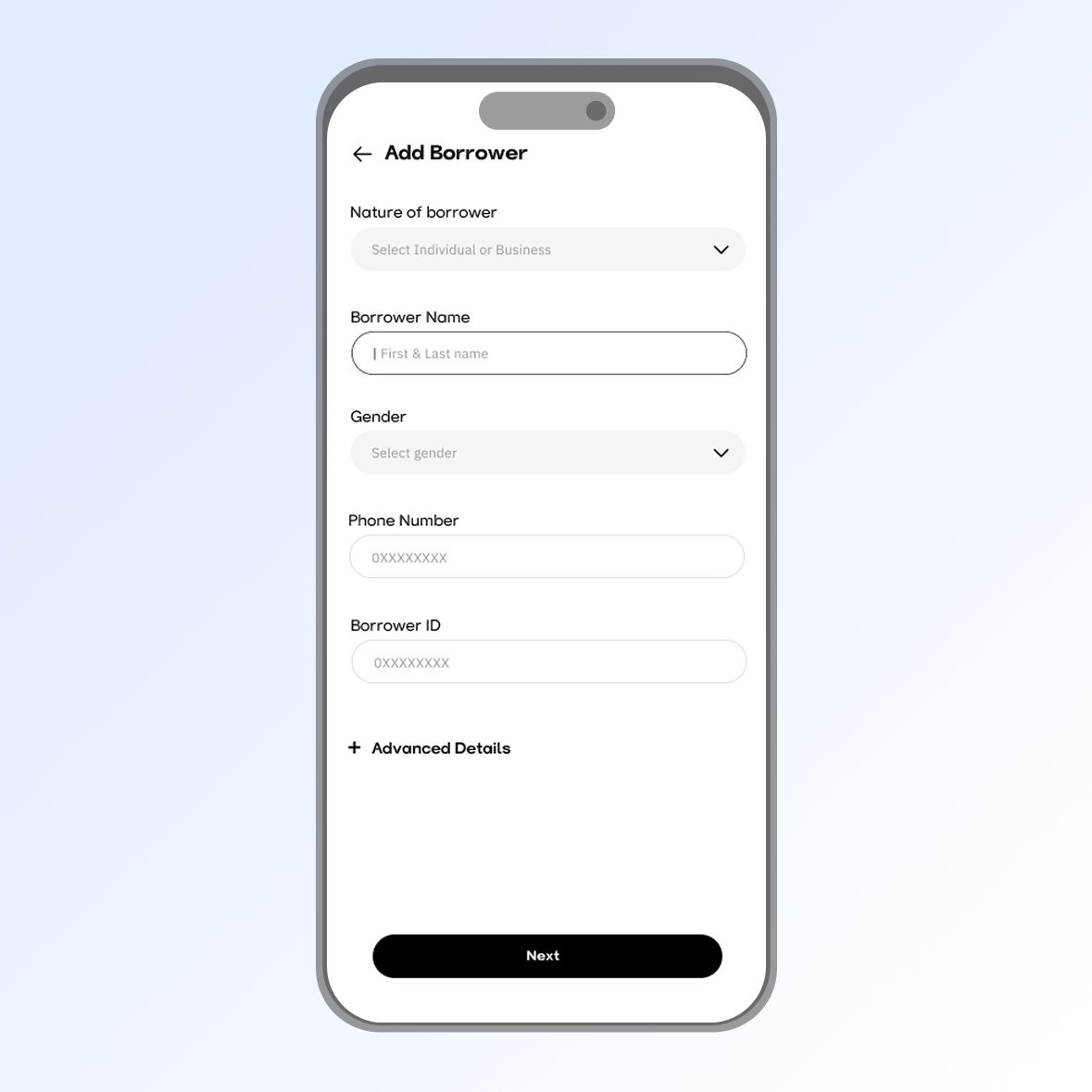

Ankara combines all the features microfinance institutions need in one platform

Complete client profiles and history:

Automated repayment monitoring:

Ankara helps microfinance institutions expand their reach and impact.

By reducing operational burdens, Ankara enables microfinance institutions to focus on their core mission of providing financial services to underserved communities.

Ankara is transforming microfinance operations across the region

Reduce loan processing time by 50% with automated workflows.

Eliminate 90% of calculation mistakes with automated interest computation.

Increase repayment rates by 30% with automated reminders.

Join hundreds of institutions using Ankara to streamline their services

Get Started Now